Jul. 07, 2022

Resource: HKSG GROUP

01 Spot freight fell for the first time

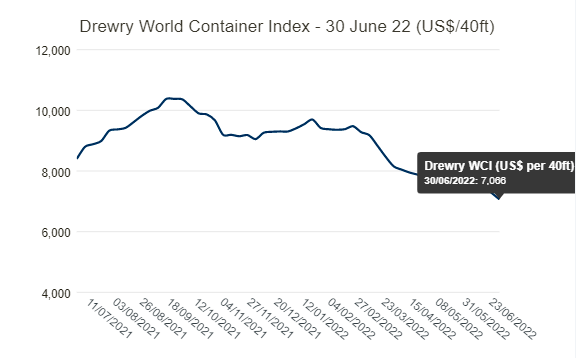

The latest World Containerized Freight Index (WCI) released by British consultancy Drewry also showed that the freight rate continued to fall by 3% last week to $7,066.03/FEU.

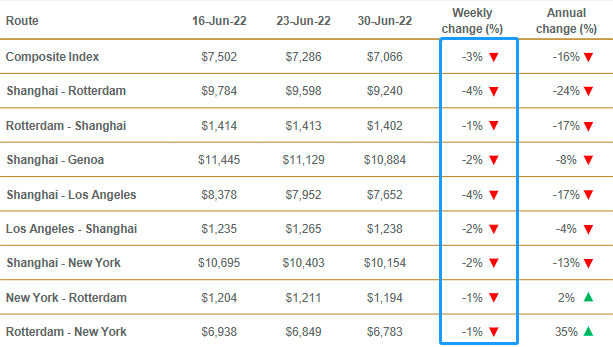

It is worth noting that for the first time, the spot freight rate of the index, which is based on the 8 major routes of Asia-America, Asia-Europe, and Europe and America, has experienced a comprehensive decline for the first time.

The WCI composite index fell 3% last week and was down 16% from the same period in 2021. Drewry's year-to-date average WCI composite index is $8,421/FEU, still $4,930 above the five-year average of $3,490/FEU.

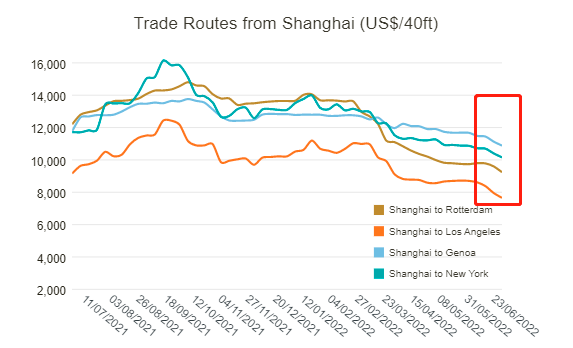

l Shanghai-Los Angeles spot freight fell 4% or $300 to $7,652/FEU. That's down 16% from the same period in 2021.

l Shanghai-New York spot rates fell 2% to $10,154/FEU. That's down 13% from the same period in 2021.

l Shanghai-Rotterdam spot freight fell 4% or $358 to $9,240/FEU. That's down 24% from the same period in 2021.

l Spot freight rates from Shanghai to Genoa fell 2% to $10,884/FEU. That's down 8% from the same period in 2021.

02 Freight rates will continue to drop in the coming weeks

Some industry investment consultants said that the super cycle of shipping has ended, and the freight rate will decline rapidly in the second half of the year.

According to its forecast, the growth of global container transportation demand will decelerate from 7% in 2021 to 4% and 3% in 2022 and 2023, and the third quarter will be a turning point.

From the perspective of the overall supply and demand relationship, the supply bottleneck has been opened, and the loss of transportation efficiency is no longer. In 2021, a 5% increase in vessel loading capacity will result in a 26% loss in efficiency due to port congestion, dragging down real supply growth by only 4%.

However, in the period of 2022 and 2023, with the widespread vaccination of vaccines, the knock-on effect of the original restrictions on port loading and unloading has been significantly eased since the first quarter. Truck and multimodal operations have gradually resumed, container flow has accelerated, and the number of dock workers quarantined has been reduced. Removing slack, increasing the speed of ships, etc.

It is worth noting that once demand declines in the third quarter, transportation efficiency is expected to be further improved. It is expected that with the gradual recovery of the 26% efficiency loss caused by the port congestion, the actual supply growth will accelerate to 25% and 13% in the same period.

The third quarter is the traditional peak season for shipping. According to industry insiders, according to the usual practice, European and American retailers and manufacturing companies began to pull goods in July. I am afraid that the price trend will be clearer until mid-to-late July.

Analysts believe that the current market is full of variables. Factors such as the Russian-Ukrainian conflict, global strikes, Fed rate hikes, and inflation may curb demand in Europe and the United States. In addition, the cost of raw materials, transportation and logistics is high, and foreign trade manufacturers tend to be conservative in preparing materials and production. At the same time, the number of ships in the port of Messiah decreased, the supply of transportation capacity increased, and the freight rate continued to adjust at a high level.