Jun. 20, 2022

Resource: HKSG GROUP

Resource: HKSG GROUP

Shanghai reopened after two months of lockdown. Combining the latest major shipping indexes, SCFI and NCFI indexes all stopped falling and returned to orders, with a slight increase for almost 4 consecutive weeks. The trend of freight rates on different routes is differentiated, and European and American routes continue to decline; South America, Australia, New Zealand, Southeast Asia, and the Middle East have increased significantly. .

The major WCI airline indices remained stable, the US route showed a downward trend, and the European route was relatively stable in recent weeks.

According to the latest data from Drewry, there will be some 760 scheduled sailings between weeks 24 and 28 (June 13-July 17) on major routes such as the Trans-Pacific, Trans-Atlantic, Asia-Nordic and Asia-Mediterranean. 75 voyages have been cancelled, and the world's three major shipping alliances have successively cancelled a total of 54 voyages.

Among them, the most cancelled voyages are 2M alliance with 27 voyages; THE alliance with 20 voyages; the fewest with 7 voyages cancelled by the Ocean Alliance; 75% of which are on the trans-Pacific eastbound route, mainly to the west of the United States.

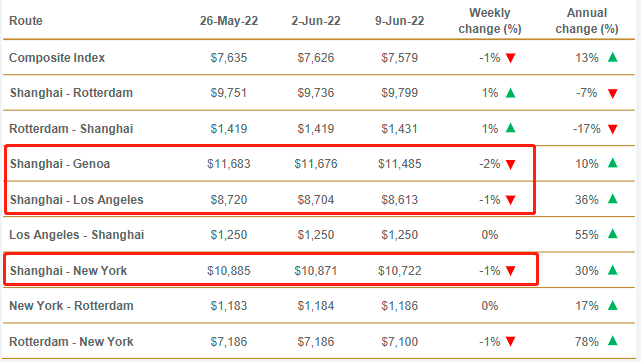

The Drewry Composite Average WCI fell 0.6% to $7,578.65/FEU for the current period, but was still 13% higher than the same period in 2021.

l Shanghai-Los Angeles and Shanghai-New York rates both fell 1% to $8,613/FEU and $10,722, respectively.

l The spot freight rate from Shanghai to Genoa fell by 2% or US$191 to US$11,485/FEU.

l Shanghai-Rotterdam freight rose 1% to $9,799/FEU.

Drewry expects the index to slowly decline in coming weeks

Drewry said that after two months of lockdown, operations at the Shanghai port are returning to normal, with factories no longer operating under closed-loop conditions and restrictions. The focus has shifted to concerns about the peak season and the number of empty containers returning to Shanghai port.

Shippers operating in the trans-Pacific trade should brace for a new round of disruption, as the U.S.-West labor negotiations are likely to coincide with a surge in shipments from China.

While it is unclear whether an agreement will be reached before the contract expires on July 1, there is a risk that negotiations could take months to reach a conclusion.

Last week, China's export container transportation market continued to be stable. Recently, the Shanghai Composite Export Container Freight Index released by the Shanghai Shipping Exchange was 4,233.31 points, up 0.6% from the previous issue.

Although the SCFI freight index rose for 4 consecutive weeks, the main European and American routes continued to decline.

European routes: Affected by the epidemic and the conflict between Russia and Ukraine, the future economic recovery in Europe will face the dual tests of high inflation and energy crisis. At present, the transportation market continues to remain stable, and the market freight rate drops slightly.

In the latest issue, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the European base port market was US$5,843/TEU, down 0.2% from the previous issue.

Mediterranean routes: The spot market booking price dropped slightly. In the latest issue, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean base port market was US$6,557/TEU, down 0.2% from the previous issue.

North American routes: The freight rates (shipping and shipping surcharges) for the latest Shanghai port exports to the west and east of the United States are US$7,630/FEU and US$10,098/FEU, respectively, down 1.0% and 1.3% from the previous issue.

Persian Gulf route: The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Persian Gulf basic port market is US$3,267/TEU, up 7.5% from the previous issue.

Australia-New Zealand route: The freight rate (sea shipping and shipping surcharges) for exports from Shanghai Port to the basic port of Australia and New Zealand is US$3,405/TEU, up 1.7% from the previous issue.

South America routes: The freight rate (sea shipping and shipping surcharges) for exports from Shanghai Port to South American base ports is US$7,216/TEU, up 7.7% from the previous issue.

The Ningbo Export Container Freight Index (NCFI) released by the Ningbo Shipping Exchange closed at 3540.7 points (from June 4 to June 10), up 0.1% from last week. Among the 21 routes, the freight index of 11 routes increased, and the freight index of 10 routes decreased. The key route indices are as follows:

European routes:The supply and demand fundamentals of European routes are generally stable, and the spot market booking price fluctuates less this week.

l The freight index of European routes was 4302.3 points, up 0.7% from the previous issue;

l The freight index of the east route was 4089.0 points, down 0.7% from the previous issue;

l The freight index of the west route was 4885.2 points, down 0.3% from the previous issue.

North American routes: There is a certain surplus of shipping space on the route, most liner companies cut prices to attract cargo, and the spot market booking price fell slightly.

l The freight index of the US-East route was 3435.9 points, down 1.9% from the previous issue;

l The freight index of the US-Western route was 4667.1 points, down 2.8% from the previous issue.