Jun. 06, 2022

Resource: HKSG GROUP

According to the import and export data released by the General Administration of Customs, the year-on-year growth rate of my country's exports in April was only 3.9%, a sharp drop from the 14.7% growth rate in the previous month. In the Yangtze River Delta region, the growth rate of imports and exports in the three provinces and cities of Jiangsu, Zhejiang, and Shanghai from January to April all declined compared with the previous period. From an industry perspective, the growth rates of exports of textile products, furniture, and clothing in labor-intensive fields all dropped sharply. In April, the export value of mechanical and electrical products increased only slightly by 0.11% year-on-year, the lowest increase since June 2020. Among them, as a traditional advantageous area of Jiangsu's foreign trade, Jiangsu's exports of mechanical and electrical products fell by 16% in April.

The fall in international shipping prices may be one of the rare good news in the field of foreign trade this year. But the drop in shipping costs alone does not solve the underlying problem. According to the feedback from the merchants in Yiwu International Trade City, the main problem is that the order is small and the volume is small. Analysis of the reasons, for the global economic downturn and sluggish consumption, shrinking transaction volume. On the other hand, rising raw material prices have also pushed up production costs. In addition, the poor logistics caused by the epidemic in many places in China since March has made it even worse.

Since the second half of 2020, international shipping prices have been soaring. Taking the route from China to the western United States as an example, the freight rate of a 40-foot standard container has risen from about US$2,000 before the outbreak to a peak of US$20,000 to US$30,000. Not only that, overseas ports have been affected by the epidemic, which has led to a sharp drop in the container turnover rate. "Sky-high freight" and "hard to find a container" have been the biggest troubles for practitioners in the foreign trade industry in the past two years. This year, things have changed. After the Spring Festival, sea freight prices have been visibly falling all the way down.

Recently, global container shipping prices have been adjusted, and freight rates on some routes have declined to a certain extent. According to the FBX index released by the Baltic Shipping Exchange, on May 26, the FBX container shipping price (mainly the shipper's quotation) continued to decline with an average of US$7,851 (down 7% from the previous issue), which was higher than the historical high in September last year. , has fallen by nearly a third.

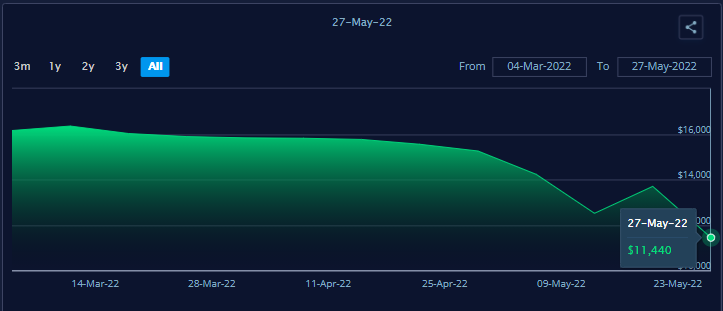

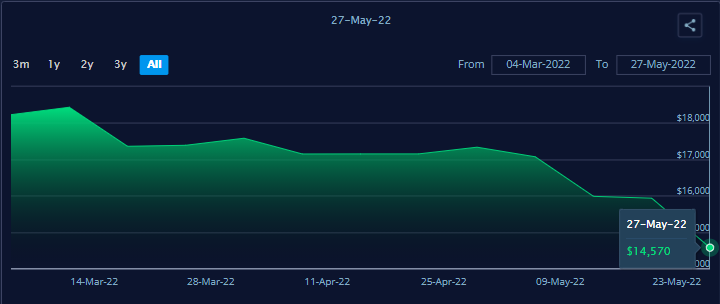

Among them, the freight rate of China/Far East-North America West Coast route decreased by 45.9% to USD 11,440/FEU (down 16% from the previous issue) compared with the highest freight rate last year, and the freight rate of China/Far East-North America East Coast route decreased by 34.3% to USD 14,570/FEU. FEU (down 9% from the previous issue), the freight rate of China/Far East-Northern Europe route dropped 29.7% to US$10,583/FEU (flat from the previous issue).

However, the SCFI (mainly quotations from shipping companies) released by the Shanghai Shipping Exchange on May 20 showed that the freight rate of the Shanghai-West America route fell only 2.8% from the highest point. This is mainly due to the large price difference between the actual carrier and the actual shipper. Has the previously high sea freight price dropped across the board? What will change in the future?

According to the analysis of Zhou Dequan, chief economist of Shanghai International Shipping Research Center of Shanghai Maritime University and director of Shipping Development Research Institute, according to the current performance of the container shipping market, when there is a concentrated release of demand and the shortage of effective supply, the market freight rate will remain high; When the two appear at the same time, the market freight rate may rise sharply.

Judging from the current demand rhythm. Although the world's ability to adapt and control the epidemic continues to increase, the epidemic will continue to recur, demand will still show intermittent expansion and expansion, and domestic exports are still relatively strong, but the impact of the rhythm of demand has entered the second half.

From the perspective of effective supply development. The global logistics supply chain capacity is recovering, and the ship turnover rate is constantly improving. If there are no other unexpected factors, it should be difficult for the container shipping market to rise on a large scale. Coupled with the rapid growth of ship orders in the past two years, the effective shipping capacity of ships has gradually been released, and there will be great challenges in the future high freight rates in the market.

In the first half of this year, the container shipping market has a high concentration, the rent of ships, fuel costs, and crew wages have increased significantly, and the operating costs of shipping companies have risen sharply compared with previous years. In addition, the ship operation rate has been at a high level in the past two years, and there is a need for a large number of maintenance and other aspects of ships. Shipping companies still have more room to operate in terms of stabilizing freight rates, and it is difficult for container shipping prices to adjust significantly. At the same time, despite the repeated epidemics and the conflict between Russia and Ukraine, there is great pressure to reduce freight rates in northern Europe and related routes, but it is less likely that container shipping prices will be significantly reduced.

With the control of this round of the epidemic and the early arrival of the peak shipping season, there are still periodic risks in the rhythm of demand and effective supply, and with the current balance of supply and demand still relatively fragile, the market freight rate is likely to rebound. Therefore, the market freight rate will remain high in the short term.